Prohibited Transactions

Avoiding Prohibited Transactions with Self-Directed IRAs

Although there is tremendous flexibility in how you invest your self-directed IRA, there are some restrictions on how you can invest your account. The best thing about a Self-Directed IRA is that it is self-directed, which means you have the freedom to choose your investments. However, with great flexibility comes great responsibility. You are 100% responsible for investing your account in full compliance with these rules. Your custodian does not approve or locate investments for you and cannot give you tax, legal, investment, or deal structuring advice.

Investment Restrictions – What Your IRA Cannot Invest In

There are three basic sets of restrictions on Self-Directed IRAs that you need to be aware of: people restrictions, transaction restrictions, and investment restrictions.

The Internal Revenue Code does not say anywhere what investments are acceptable for an IRA. The only guidance in the code is what investments are not acceptable – life insurance contracts and “collectibles”. “Collectibles” are defined as any work of art, any rug or antique, any metal or gem, any stamp or coin, any alcoholic beverage, and any other tangible personal property specified by the Secretary. An exception to these restrictions exists for certain U.S. minted gold, silver and platinum coins, coins issued under the laws of any state, and gold, silver, platinum or palladium bullion. If you direct your IRA to invest in any prohibited collectible, your IRA will be deemed to be distributed to you to the extent of the investment. Additionally, S corporations do not allow IRAs as permitted shareholders.

- Life Insurance

- Collectibles

- S Corporations

Person Restrictions – Who Your IRA Cannot Do Transactions With

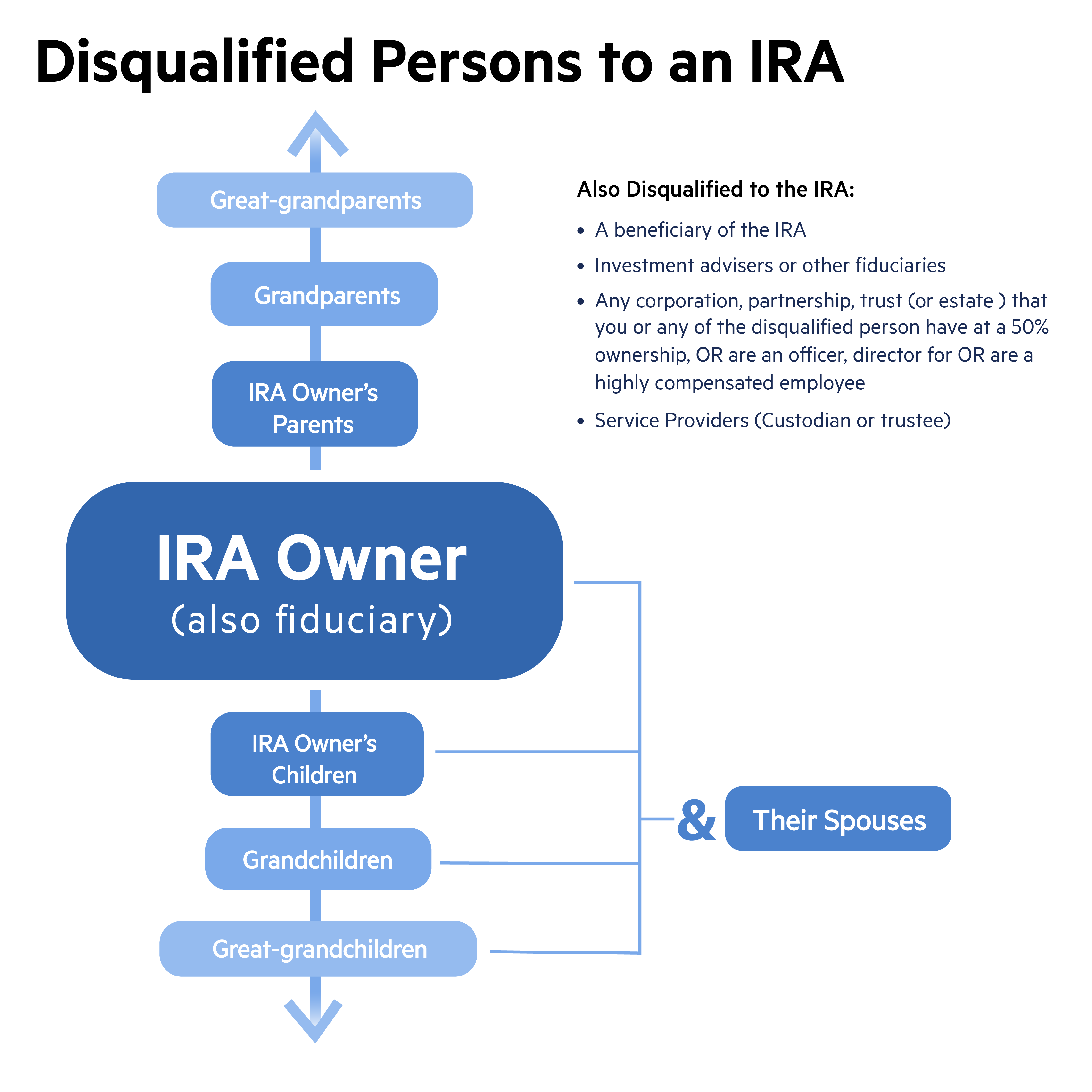

Although with a Self-Directed IRA you have great freedom to choose your investments, there are certain persons with whom your IRA is not permitted to enter transactions with and who cannot benefit from your IRA’s transactions, either directly or indirectly. These are called disqualified persons. Understanding the rules for determining who is classified as a disqualified person to your IRA is crucial when you are investing with your Self-Directed IRA. It is strictly up to you to invest your account in a way that complies with all the rules and regulations, including the prohibited transaction rules. Transacting with a disqualified person can come with significant consequences, such as the account losing its tax-advantaged status.

Disqualified Persons (DQP) include, but are not limited to, the following:

- The account owner and any other fiduciary, such as an investment advisor;

- A service provider to the IRA;

- Certain family members, including lineal ancestors and descendants and their spouses;

- Any entity which is disqualified because it is owned 50% or more by certain other disqualified persons;

- Certain officers, directors, shareholders, and employees of a disqualified entity;

- A 10% or more partner of a disqualified entity.

Note: This is not an exclusive list, but it covers the most common disqualified persons to your IRA. For more details on who is a disqualified person to your IRA please review Internal Revenue Code Section 4975(e)(2). You may also review Appendix A in written by H. Quincy Long, founder and CEO of Quest Trust Company, which is entitled “Self-Directed IRA Secrets Revealed.”

Transaction Restrictions – What Your IRA Cannot Do Legally

The third set of restrictions you have to understand is the prohibited transaction rules. Essentially, these rules specify what you are not permitted to with the disqualified persons listed above. These restrictions can be found in Section 4975(c )(1) of the Internal Revenue Code.

The prohibited transaction rules prohibit any direct or indirect–

- Sale or exchange, or leasing, of any property between an IRA and a disqualified person;

Example: leasing a property owned by your IRA to your son and daughter-in-law - Lending of money or other extension of credit between an IRA and a disqualified person;

Example: loaning money or extending credit to your 10% or more business partner in an entity of which you own 50% or more - Furnishing of goods, services, or facilities between an IRA and a disqualified person;

Example: building a house with your own labor and materials on land owned by your IRA Transfer to, or use by or for the benefit of, a disqualified person of the income or assets of the plan;

Example: Receiving an asset payoff in your personal checking instead of sending back to the custodian - Act by a disqualified person who is a fiduciary whereby he deals with the income or assets of a plan in his own interest or for his own account; or

Example: staying in a vacation property owned by your IRA - Receipt of any consideration for his own personal account by any disqualified person who is a fiduciary from any party dealing with the plan in connection with a transaction involving the income or assets of the plan.

Example: Accepting a sales commission for the purchase or sale of a property owned or purchased by your IRA

Crime and Punishment – What Happens to Your IRA if You Make a Mistake?

For the IRA Owner. If the IRA owner enters into a prohibited transaction during the year, the IRA ceases to be an IRA as of the first day of that taxable year. The value of the entire IRA is treated as a distribution for that year, and if the IRA owner is not yet 59 1/2, there could be premature distribution penalties also. Since the IRS often does not catch the prohibited transaction for several years, additional penalties can accrue for underreporting income from transactions in years after the prohibited transaction took place.

For Other Disqualified Persons. Initially, an excise tax of 15% of the amount involved for each year (or part of a year) is imposed by any disqualified person who participated in the prohibited transaction. An additional tax equal to 100% of the amount involved is also imposed on a disqualified person who participates in the prohibited transaction if the transaction is not corrected within the taxable period.

Every investor should know about IRA prohibited transactions. Quest Trust Company provides a series of articles to help you make the right decisions.