Get our e-newsletter for all the exciting updates, events notices and valuable education

IRA Administrator vs IRA Custodian - What's the Difference?

Think IRA custodians and administrators are the same? Learn how the two are different to see which one is a better fit for you.

Posted on July 7, 2022

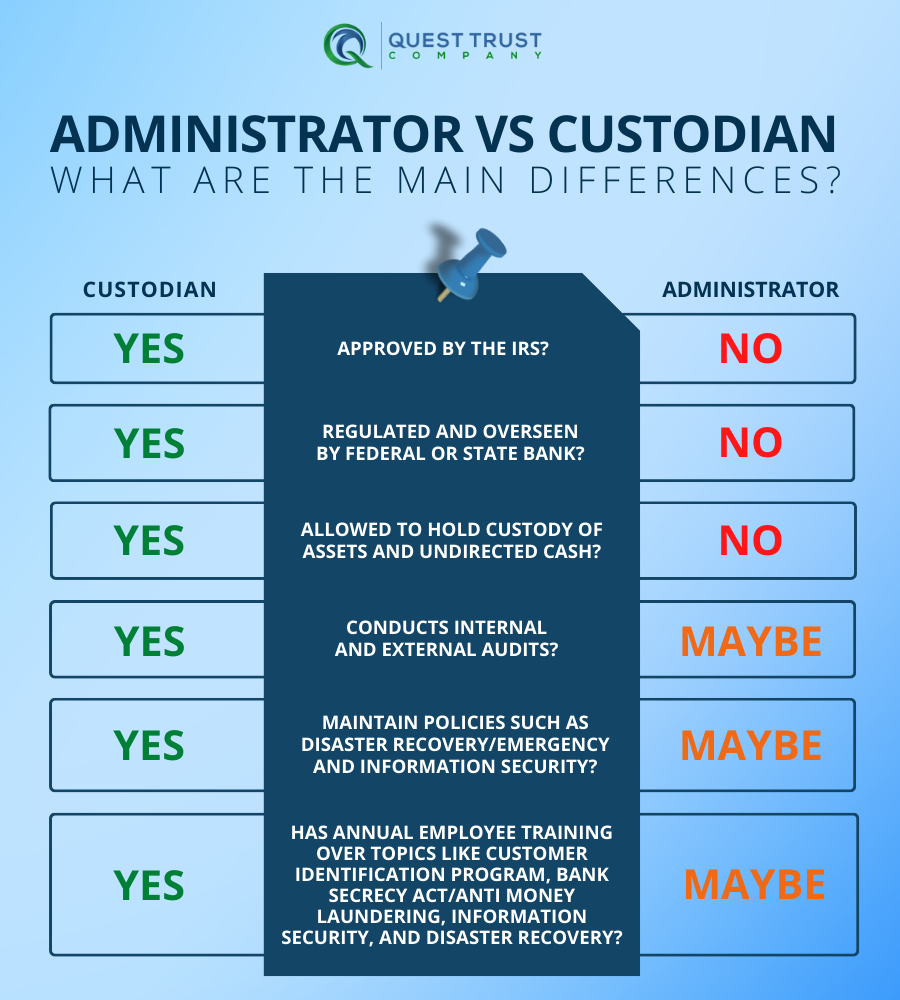

When you hear the term “custodian” and “administrator”, you might think that they are the same and can be used interchangeably, but they’re actually two very different types of IRA providers. Both have a very defined role and play their part when it comes to self-directed IRA retirement plans, but it’s important to understand the function of both entities.

IRA Custodians

- IRAs must have an appointed custodian, no matter the account type or even if the account is self-directed.

- All custodians like Quest Trust Company are required to meet Federal IRS requirements.

- Every custodian is overseen by state or federal bank regulators.

- It is very important to remember custodians are allowed to hold custody of assets.

IRA Administrators

- Administrators act more like middlemen who work with a custodian to provide their services.

- They are the neutral party responsible for account maintenance, administration of paperwork, and related account filing.

- Administrators and custodians can be two separate entities, but other times can be both under the same parent corporation.

Federal Requirements

One of the biggest differences is regulation. While many administrators claim to be regulated, this is in fact not the case. Custodians have onsite examinations conducted by bank regulators to check that they follow standard rules and that they are financial stable. Both may put policies in place, like information security policies and emergency/disaster recovery policies, and can conduct internal and external audits, but administrators are not required to implement any policy while custodians are. The same goes with training; custodians require annual employee training over a variety of topics such as Customer Identification Program, Bank Secrecy Act/Anti Money Laundering, Information Security, and Disaster Recovery while administrators are not required.

To put it simply, the custodian will hold title to your assets on behalf of your IRA and are responsible for IRS reporting, while the administrator will simply execute your investments according to your instructions. Differentiating the two really comes down to regulations and how much responsibility each one has. We’ve included a helpful infographic below to better explain the differences for what each one can do!

When deciding which custodian and administrator you want to go with, always be sure to do your own due diligence, just as you would do with an investment before entering into a new deal. Make sure they understand the asset class you plan to invest into, whether that be more traditional or alternatives, like those offered at Quest Trust Company. Self-directing an IRA at a custodian like Quest can give you peace of mind knowing that your account has an extra level of security and that your IRA is being protected by many regulations. If you have any questions about self-directed IRAs at Quest Trust Company, our specialists are here to help. Schedule a free call today!